when creating a budget log fixed expenses. Budgeting can help you to make the most of your money and prevent you from overspending. However, anyone can benefit from creating and following a budget, especially if they are living on a fixed income. This Turbo Blog can get you on the right track starting at age 30.Many people think that budgeting is only for people with a lot of money.

We’ve all heard the saying “save for a rainy day”. If you do find any errors, you need to contact all three credit bureaus and have them corrected. Review your credit report and make sure there are no errors.

WHEN CREATING A BUDGET LOG FIXED EXPENSES FREE

In addition, if you were denied credit recently, you have the right to a free copy of your credit report even if you already received a free copy that year. Check your credit report once a year. Everyone is entitled to one free copy of their credit report from each of the three agencies each year.If you choose to close a credit card, make sure your credit report indicates that you, the customer, requested it to be closed.Avoid having too many credit cards. When your credit score is computed, if you have too much credit available to you, it can be seen as a risk.If it's a want and not a need, then the purchase may needlessly put you deeper in debt. A good rule of thumb to keep in mind: if you can't pay for it now, ask yourself if it's something you really need, or is it just something that you want.Stay within your credit limits. Ideally you should stay within 30% since lenders look at how much credit is available to you, and how much you are actually using.Here are a few tips to get, and keep, a high credit ( FICO) score:

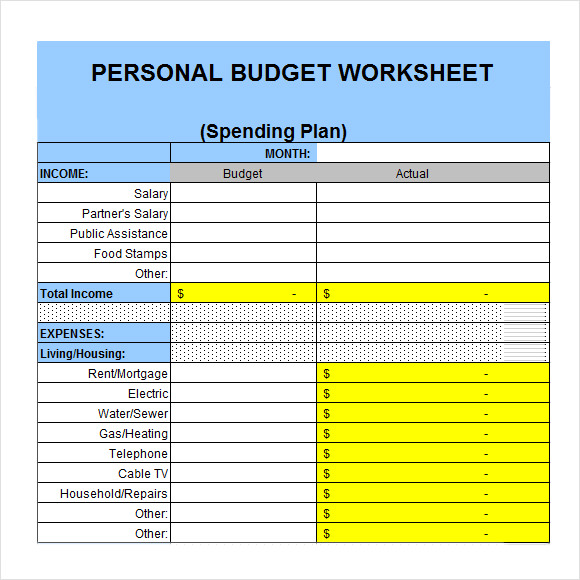

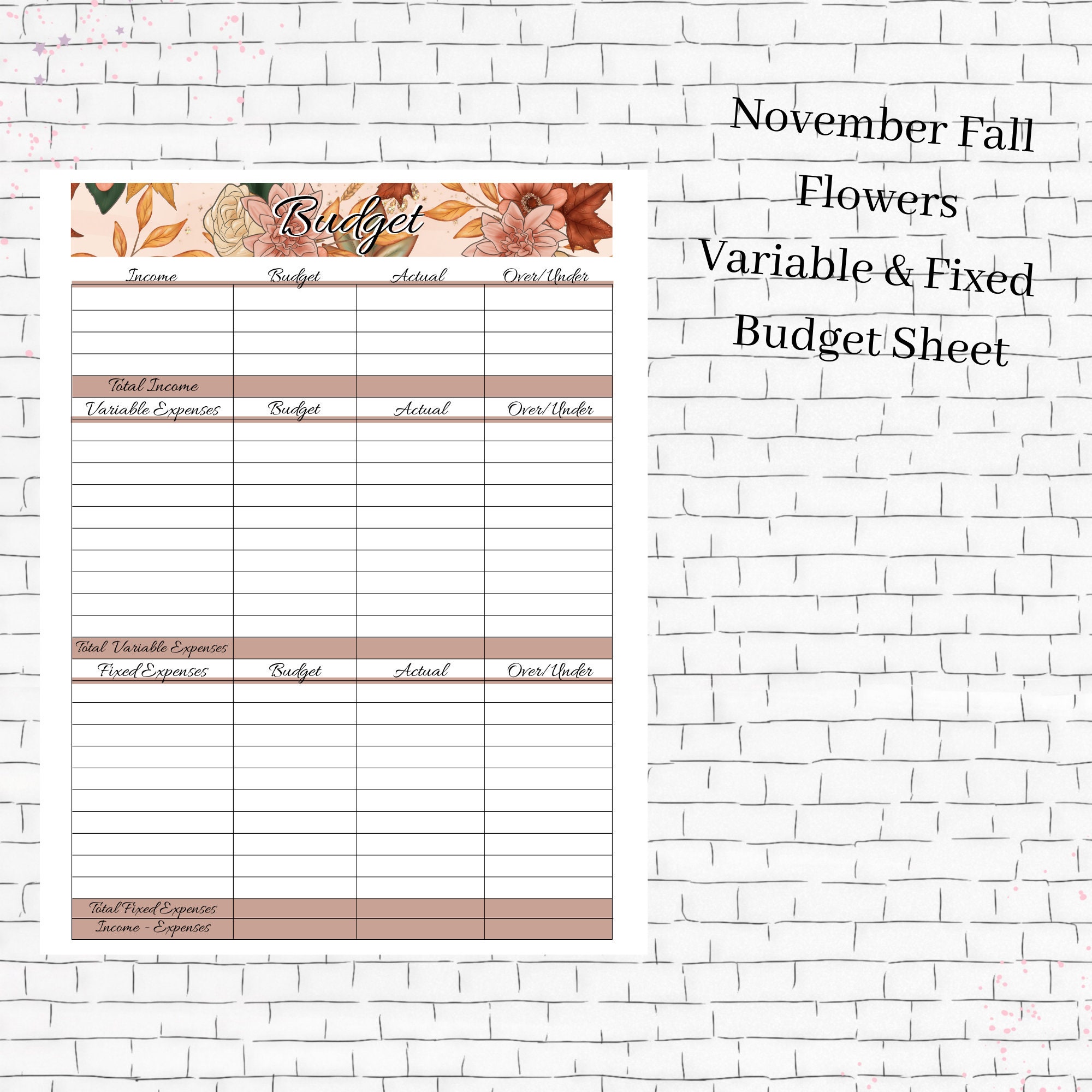

A higher score is an indication of an individual who manages credit wisely. Each time you apply for new credit, at least one of those agencies sends a report with details of your credit history. So how do you build good credit? If you have a credit card or loan, information about your spending and repayment patterns is already being sent to credit to the three main credit reporting bureaus ( Equifax, Experian, and TransUnion). Some student loans even require you to have good credit. In order to get a loan, you will need to have a good credit. If you plan to buy a house or a car, you will need to get a loan. Department of Education's Federal Student Aid website > Budgeting Be realistic - it doesn’t make sense to create a financial plan that’s so restrictive you can’t live with it. If your resources are more than your expenses, great! If not, you’ll need to take a hard look at your resources and expenses. Once you know what your expenses are, create a spreadsheet or use a budget worksheet, entering your resources and expenses.

WHEN CREATING A BUDGET LOG FIXED EXPENSES DOWNLOAD

Start a log in your smart phone, download a free app, or go old school and carry a small notebook. For those flexible expenses, it might be helpful to track what you spend each day for a month. Utility bills, food (including that latte you grab on the way to class), and entertainment are flexible expenses. Rent, room and board if you live on campus, and car payments are fixed expenses flexible – these amounts change from month to month. Expenses fall into two basic categories: fixed – these are the same amount every month. It will help you manage your expenses and keep you on the right path to achieve your financial goals.īefore you can create a budget, you need to know what you spend in an average month. Creating a budget is the first step to developing a workable spending plan.

0 kommentar(er)

0 kommentar(er)